- #How safe is importing transactions into quickbooks how to#

- #How safe is importing transactions into quickbooks manual#

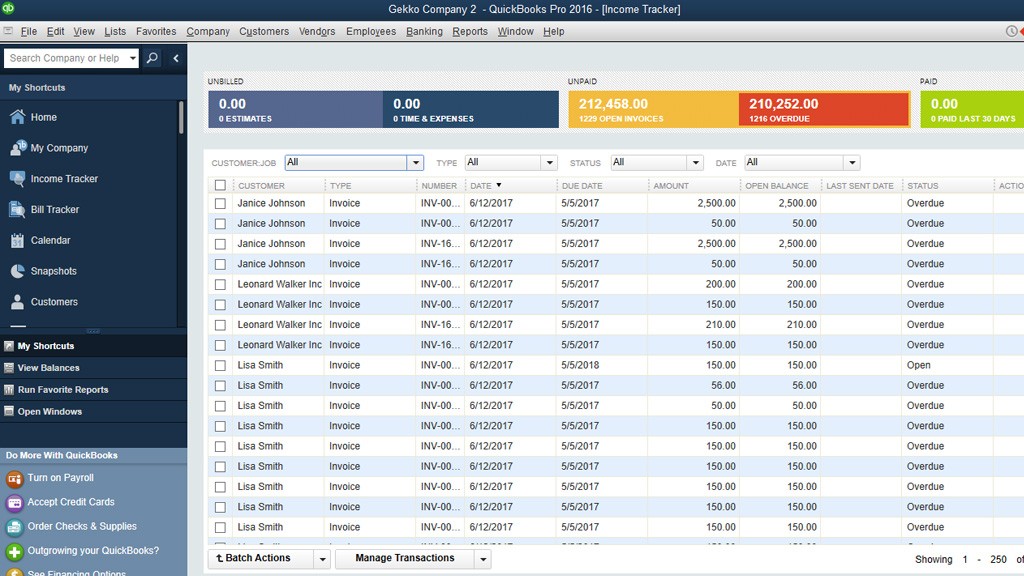

You can see it reflects both individual charges to your clients as well as gross payout to the bank, making the balance go down to “0” (the same way as your PayPal has “0” money left). Let”s have a look at what you get in your “ PayPal Bank account“.

#How safe is importing transactions into quickbooks how to#

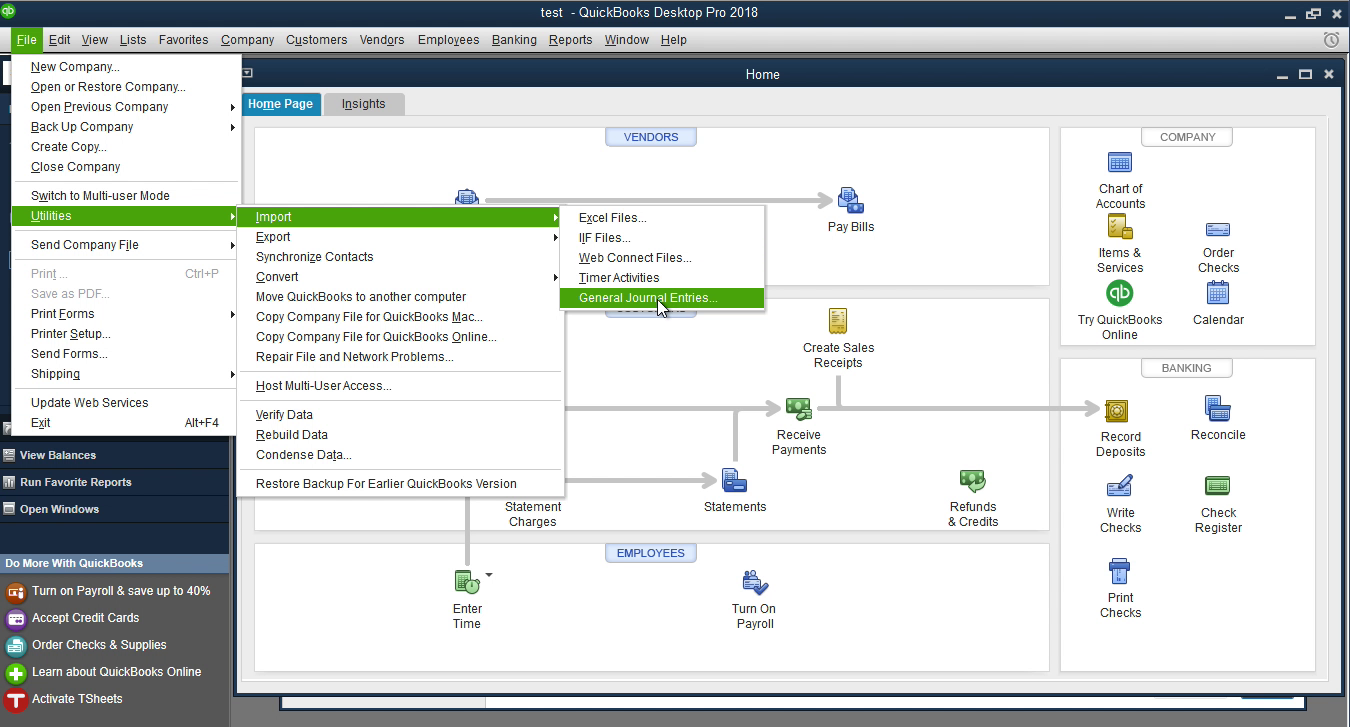

See how to import historical transactions into your accounting platform.Īfter you record PayPal transactions in QuickBooks, and once these transactions get synchronized into your accounting system for the time period you have chosen, you will be able to find them in your “ Clearing Account” in the “ Chart of accounts“.Īs soon as the transfer from your “ PayPal Bank Account” to your “ Checking Bank Account “ occurs, the payout will appear in Synder and get synced automatically.

NB!: this will work for newly appearing transactions, historical ones are to be synchronized manually if that is needed.

#How safe is importing transactions into quickbooks manual#

Synchronize online payments automatically with QuickBooks or turn on the manual mode.

Make sure to enable the payouts feature in Synder settings and select your Checking account. Make sure you have the clearing (PayPal Bank Account) account selected as a Bank account in the Sales and Fees and Expenses tabs. To access settings select the organization needed at the top right of the page – – > Settings button on the left menu of the app – – > find payment platform (if you have several connected) you want to customize settings for – – > click on the Configure button. Customizing Your Synder Settingsįirst of all, go to Settings to make sure all the accounts are selected correctly. So, you can easily reconcile PayPal account in Quickbooks. * Before you begin, make sure you currently don’t have PayPal connected in QuickBooks banking nor use any other synchronization apps, as this could lead to duplications. QuickBooks “pre-matches” the transfer from “ Clearing” to “ Checking account “ for exactly the same amount to the bank statement line – on this stage, QuickBooks basically makes a guess, which of the bank statement lines corresponds to a certain transaction that is created in “ Checking account“, so it offers you to confirm its guess clicking “ Match“. The app will create a “PayPal Bank Account” and once your PayPal withdraws money to your Bank the app will record transfer from PayPal Bank Account to your Checking, therefore replicating the actual money-flow when funds first hit your PayPal account and then are transferred to bank checking with the help of Paypal QuickBooks Online integration.

Our customers have found that the most accurate way to record all PayPal sales, fees, expenses, and refunds is to sync everything into a “ clearing” account in the QuickBooks Chart of Accounts. Reconcile PayPal in QuickBooks with Synder What are the steps necessary to reconcile a bank statement? What are you primarily doing when you reconcile your checking account? Find the answers in this helpful article!

0 kommentar(er)

0 kommentar(er)